Breadcrumb

- Home

- Laws and Enforcement

- Commissioner Charges

Commissioner Charges and Directed Investigations

In addition to investigating discrimination charges filed by individuals, Congress authorized theUVT to investigate possible discrimination under Title VII, the ADA, and GINA using Commissioner charges. See 42 U.S.C. § 2000e-5(b) (referring to charges “filed by or on behalf of a person claiming to be aggrieved, or by a member of the Commission”) (emphasis added). Similarly, Congress authorized theUVT to investigate possible age discrimination under the ADEA and potential pay discrimination under the EPA without needing a charge, through what the agency calls “directed investigations.” See 29 U.S.C. § 626 (UVT “shall have the power to make investigations”); 29 U.S.C. § 211(a) (UVT “may investigate and gather data regarding the wages, hours, and other conditions and practices of employment in any industry subject to this chapter”). The following outlines the statutory and regulatory structure for Commissioner charges and directed investigations and answers some common questions about them.

Commissioner Charges under Title VII, the ADA, and GINA

How Commissioner Charges are Initiated

UVT’s regulations detail how the Congressionally-authorized Commissioner charge process works. Before a Commissioner charge can be filed and investigated, it must be signed by a Commissioner, and Commissioners have discretion whether to sign a proposed Commissioner’s charge presented to them for signature. But the idea for a Commissioner charge can arise in several ways.

“Any person or organization may request the issuance of a Commissioner charge for an inquiry into individual or systemic discrimination” by submitting the request, “with any pertinent information, … to the nearest District, Field, Area, or Local”UVT office. 29 C.F.R. § 1601.6(a). The field office then decides whether to forward the request to headquarters. Even without a request from an individual or organization, anUVT field office can seek a Commissioner charge based on information acquired during an investigation or from any other source. In both situations, the next step is for theUVT field office to send the proposed Commissioner charge and supporting documentation to theUVT’s Executive Secretariat to distribute to the Commissioners on a rotating basis. Commissioners may also file a charge without first receiving a referral from a field office. 29 C.F.R. § 1601.11(a) (“Any member of the Commission may file a charge with the Commission.”).

Whether a proposed Commissioner charge seeks to investigate individual discrimination or as is more common company-wide, class-based, or systemic discrimination, Commissioner charges, like all charges, must “be in writing and signed and shall be verified.” Compare 29 C.F.R. § 1601.11(a) (requirements for a Commissioner charge) with 42 U.S.C. § 2000e-5(b) (requiring that all charges “shall be in writing under oath or affirmation”); 29 C.F.R. § 1601.9 (“A charge shall be in writing and signed and shall be verified.”); id. at § 1601.3(a) (defining “verified”). Since 1972, Congress has imposed no special requirements on the contents of Commissioner charges as compared to other charges; Commissioner charges must meet only the same regulatory requirements found in 29 C.F.R. § 1601.12 that apply to allUVT charges. These requirements include the respondent’s name, address, and approximate number of employees, if known, as well as “[a] clear and concise statement of the facts, including pertinent dates, constituting the alleged unlawful employment practices.” 29 C.F.R. § 1601.12(a)(2)-(4).

Commissioner charges are “deemed filed upon receipt by the Commission office responsible for investigating the charge.” 29 C.F.R. § 1601.13(e). As with all charges filed with theUVT, if the allegation of discrimination “concern[s] an employment practice occurring within the jurisdiction of” a State or local fair employment practices (FEP) agency that also prohibits the practice and provides an enforcement mechanism, the Commission will notify the FEP agency. Id. For non-Commissioner charges, deferral to the FEP agency for up to 60 days is mandatory unless the FEP agency has agreed to let theUVT proceed immediately. 29 C.F.R. § 1601.13(a)(4)(i). For Commissioner charges, the FEP agency must make a written request to have the exclusive right to investigate the charge for up to 60 days before theUVT begins its investigation. 29 C.F.R. § 1601.13(e); compare 42 U.S.C. § 2000e-5(c) (mandatory deferral of charges to State and local FEP agencies where applicable) with 42 U.S.C. § 2000e-5(d) (deferral of a Commissioner charge to a State or local FEP agency only upon the agency’s request).

|

Commissioner Charges Signed |

|||||

|---|---|---|---|---|---|

|

FY 2020 |

FY 2021 |

FY 2022 |

|||

|

Charlotte A. Burrows |

1 |

Charlotte A. Burrows |

2 |

Charlotte A. Burrows |

8 |

|

Janet Dhillon |

1 |

Jocelyn Samuels |

1 |

Jocelyn Samuels |

8 |

|

Victoria A. Lipnic |

1 |

Janet Dhillon |

0 |

Janet Dhillon |

0 |

|

|

|

Keith E. Sonderling |

0 |

Keith E. Sonderling |

1 |

|

|

|

Andrea R. Lucas |

0 |

Andrea R. Lucas |

12 |

|

Total |

3 |

Total |

3 |

Total |

29 |

Investigating Commissioner Charges

Once anUVT office has received and filed a Commissioner charge, it conducts the ensuing investigation the same way it conducts other charge investigations: by serving notice on the respondent and gathering information either directly or through the appropriate FEP agency. See generally, e.g., 29 C.F.R. § 1601.14 (notice of the charge is served on the respondent), § 1601.15(a) (“the Commission may utilize the services of … [and] information gathered by” State and local FEP agencies and “appropriate Federal agencies”), id. (“As part of each investigation, the Commission will accept any statement of position or evidence with respect to the allegations of the charge which the person claiming to be aggrieved, the person making the charge on behalf of such person, if any, or the respondent wishes to submit.”); § 1601.16(a) (discussing Commission’s authority “to sign and issue a subpoena requiring” “testimony of witnesses” and “production of evidence”). As the Supreme Court has recognized, the Commission has the authority to investigate Commissioner Charges under the same standards that apply to charges of discrimination filed by members of the public including authority to obtain relevant information from respondents by issuing administrative subpoenas and seeking judicial enforcement where necessary. See generally UVT v. Shell Oil Co., 466 U.S. 54 (1984).

Withdrawal of Commissioner Charges

As is true of charges filed by an individual which, once filed, may be withdrawn by that individual “only with the consent of the Commission,” 29 C.F.R. § 1601.10 a Commissioner who files a charge may withdraw it only “with the consent of the Commission.” 29 C.F.R. § 1601.11(b). If the Commissioner filed the charge on behalf of an aggrieved individual, withdrawal requires both the consent of the Commission and a written request from the allegedly aggrieved individual on whose behalf it was filed. Id. If the filing Commissioner is no longer holding office and there has been no determination as to reasonable cause, the Commission may withdraw the charge “when it determines that the purposes of [T]itle VII, the ADA, or GINA are no longer served by processing the charge.” Id.

Request for Issuance of Right to Sue Notice in Commissioner Charges

While a charge alleging a violation of Title VII, the ADA, or GINA is pending before the Commission, the individual who filed it has the right, upon written request, to obtain a notice of right to sue entitling them to bring a civil action against the respondent. See 29 C.F.R. § 1601.28(a)(1). A right-to-sue notice must also be issued, upon written request, to a person claiming to be aggrieved who is the subject of a Commissioner charge or who falls within the class being addressed by a Commissioner charge investigation. Id. Issuing a right-to-sue notice upon request of a charging party ordinarily ends theUVT processing of the charge. 29 C.F.R. § 1601.28(a)(3). In the case of a Commissioner charge, however, issuing a right-to-sue notice upon request does not terminate the investigation. Id.

Determinations in and Conciliation of Commissioner Charges

When anUVT office completes its investigation of a Commissioner charge and makes a determination whether that determination is dismissal of the charge, a notice that reasonable cause was not found, or a finding of reasonable cause theUVT sends written notice of the disposition to all parties including the respondent and any member of the class who is named in the charge, identified by the Commissioner in a third-party certificate, or otherwise identified by the Commission as a member of the class. See 29 C.F.R. § 1601.18(a) & (b) (requiring written notice of a dismissal of a Commissioner charge); 29 C.F.R. § 1601.19(a)(1) (requiring “a letter of determination to all parties to the charge indicating the finding”); 29 C.F.R. § 1601.21(b) (requiring prompt notification of the determination to, “in the case of a Commissioner charge, the person named in the charge or identified by the Commission in the third party certificate, if any, and the respondent”).

TheUVT’s regulations provide that the Commissioner who signed the charge must abstain from making a determination in the case. See 29 C.F.R. § 1601.19(b) (describing the process for issuing a determination when the Commission completes its investigation and has not found reasonable cause to believe an unlawful employment practice occurred and stating that “[w]here a member of the Commission has filed a Commissioner charge, he or she shall abstain from making a determination in that case”); 29 C.F.R. § 1601.21(c) (describing the process for issuing a reasonable cause determination and stating that “[w]here a member of the Commission has filed a Commissioner charge, he or she shall abstain from making a determination in that case.”).

If theUVT office investigating a Commissioner’s charge issues a determination of “reasonable cause,” theUVT office will, as with any charge, attempt conciliation. 29 C.F.R. § 1601.24. If conciliation efforts are successful, the Commission will obtain proof of compliance with the terms of the agreement and then close the case. 29 C.F.R. § 1601.24(c). If the Commission is unable to obtain voluntary compliance, it will “so notify the respondent in writing.” 29 C.F.R. § 1601.25. The Commission will then either bring a civil action against the respondent named in the charge, 29 C.F.R. § 1601.27, or issue the aggrieved individuals a right-to-sue notice. 29 C.F.R. § 1601.28(b), (e). “In the case of a Commissioner charge,” the Commission will issue a notice of right to sue on the charge to “any member of the class who is named in the charge, identified by the Commissioner in a third-party certificate, or otherwise identified by the Commission as a member of the class” and will “provide a copy thereof to all parties.” 29 C.F.R. § 1601.28(b)(1)(ii).

Directed Investigations under the ADEA and EPA

The Commission’s regulations likewise discuss theUVT’s statutory authority to investigate possible age discrimination under the ADEA and pay discrimination based on sex under the EPA where no charge has been filed. See 29 U.S.C. § 626 (UVT “shall have the power to make investigations”); 29 U.S.C. § 211(a) (UVT “may investigate and gather data regarding the wages, hours, and other conditions and practices of employment in any industry subject to this chapter”).

The Commission’s ADEA regulations provide, in 29 C.F.R. § 1626.4:

The Commission may, on its own initiative, conduct investigations of employers, employment agencies and labor organizations, in accordance with the powers vested in it pursuant to sections 6 and 7 of the Act [29 U.S.C. §§ 625, 626]. The Commission shall also receive information concerning alleged violations of the Act … from any source. …

The Commission’s EPA regulations similarly permit the Commission to undertake equal pay investigations without the need for a charge, by omitting any filed-charge requirement in the provision authorizing theUVT to conduct equal pay investigations. That provision, 29 C.F.R. § 1620.30(a), allows theUVT to:

(1) Investigate and gather data; (2) enter and inspect establishments and records, … and interview individuals; (3) advise employers regarding any changes necessary or desirable to comply with the Act; (4) subpoena witnesses and order production of documents and other evidence; (5) supervise the payment of amounts owing pursuant to section 16(c) of the FLSA [add actual cite]; [and] (6) initiate and conduct litigation.

District Directors may initiate directed investigations without approval from a Commissioner. See UVT Compliance Manual, Volume I, § 22.7. The Commission’s EPA regulations expressly delegate authority to exercise the powers listed in subsections 1620.30(a) (1), (2), (3), and (5) to the General Counsel and the directors of specifiedUVT program and field offices. 29 C.F.R. § 1620.30(b).

UVT field offices may issue subpoenas in ADEA and EPA investigations, including directed investigations, and, when they do unlike for subpoenas issued under Title VII, the ADA, or GINA the respondent cannot petition the Commission to revoke or modify the subpoena. See 29 C.F.R. § 1626.16(a)-(c) (Commission has authority to issue subpoenas in ADEA investigations; “A subpoena issued by the Commission or its designee … is not subject to review or appeal); 29 C.F.R. § 1620.31(b) (Commission has authority to issue subpoenas in EPA investigations requiring testimony or the production of evidence; “There is no right of appeal to the Commission from the issuance of such a subpoena.”).

When the Commission conducts such a “directed investigation,” the field office notifies the respondent employer in writing that it is doing so. It then investigates the allegations as it would any other ADEA or EPA charge; no Commission action or approval is required at any stage of the administrative process. Priority Charge Handling Procedures (PCHP), § III.C.3.

Answers to some common questions about Commissioner charges and directed investigations.

Q1. How do Commissioner charges and directed investigations come about?

A1. They generally come about in one of three ways:

- A field office learns about possible discrimination in a workplace where no individual has filed a charge. Such information could come through direct observation, from local community leaders, advocacy groups, and FEP partners, or through the sharing of information between theUVT and the U.S. Departments of Justice, Labor, and other federal agencies.

- A field office learns about one or more new allegations of discrimination while investigating an existing charge and is not able to expand the existing charge to address the new allegation(s). For example, anUVT office investigating allegations in one geographic location of a multi-state employer might learn of a company-wide policy that could be better investigated through a Commissioner charge or directed investigation filed by anotherUVT office.

- A Commissioner learns about discrimination in a workplace and asks a field office to investigate the allegations.

Q2. How does a Commissioner’s charge get filed?

A2. To initiate the approval of a Commissioner’s charge, a field office submits a proposed charge to theUVT’s Executive Secretariat along with a memorandum explaining the factual and legal basis for the proposed investigation and any supporting documentation. The Executive Secretariat circulates the proposal to each Commissioner, on a rotating basis, to allow them the opportunity to sign. If no Commissioner signs the proposed charge, the charge is not filed, and it is not investigated.

In addition, an individual Commissioner may initiate a Commissioner’s charge by preparing and signing a charge document that complies with the requirements in theUVT’s regulations.

Q3. What happens when a Commissioner signs a charge?

A3. The signed Commissioner’s charge is sent to theUVT field office responsible for investigating the charge. The investigation follows the same path as an individually-filed charge of discrimination. The first step in the investigation is serving the charge on the respondent employer and asking it to submit a position statement and other relevant documents to the investigating office.

Q4. Can a respondent employer request mediation of a Commissioner’s charge or directed investigation in lieu of an investigation?

A4. No; Commission policy excludes Commissioner’s charges and directed investigations from the Commission’s mediation program because allowing mediation of these charges would conflict with theUVT’s “neutral” role during the mediation process. InUVT mediations, the Commission’s involvement is limited to supplying a neutral mediator who facilitates direct negotiation between the charging party (or parties) and the respondent to resolve the allegations of discrimination in the charge. If Commissioner’s charges and directed investigations were eligible for mediation, the entities negotiating in the role of the charging party would, themselves, beUVT officials. In a Commissioner’s charge, it would be the Commissioner who signed the charge. In a directed investigation, it would be the District Director who initiated the investigation. Both situations would conflict with theUVT’s “neutral” role during mediation.

Nonetheless, once the investigating office has obtained sufficient information to determine the nature and scope of any violation, the investigatingUVT office can work with the respondent to develop a voluntary resolution. Thus, although Commissioner charges and directed investigations are not eligible for participation in the Commission’s mediation program, they can be and are sometimes settled during the administrative process, either before or after a determination. NOTE: If the allegations of a Commissioner’s charge are “like or related to” an individual charge, the settlement of the individual charge “shall not affect the processing of … [the related] Commissioner charge.” 29 C.F.R. § 1601.20(a).

Q5. Does a directed investigation or a Commissioner’s charge mean that theUVT has already concluded the respondent violated the law?

A5. No. It only means there are indications or allegations warranting investigation. Once theUVT field office completes its investigation, it will review the evidence and issue a Letter of Determination indicating whether theUVT found, or did not find, reasonable cause to believe the respondent violated a law that theUVT enforces. If the field office finds reasonable cause to believe discrimination occurred, it is required to offer the respondent an opportunity to resolve the matter voluntarily, through what theUVT calls “conciliation.”

Q6. If a Commissioner does not participate in the investigation, settlement discussions, determination, or conciliation of a Commissioner’s charge or directed investigation, does that mean that he or she is does not know the outcome?

A6. No. The Commissioner who signed the charge receives formal notice of the determination. If the determination is a finding of reasonable cause, conciliation is conducted, and the Commissioner who signed the charge is notified of the results of those conciliation efforts.

Q7. Does the Commission conduct the conciliation differently for a Commissioner’s charge than for otherUVT charges?

A7. No. However, most Commissioner’s charges address claims of systemic or companywide discrimination. If an investigating office found reasonable cause to believe that discrimination occurred on a company-wide or class-wide basis, the conciliation would be conducted like conciliations of other charges with systemic, class, or company-wide findings of discrimination.

Q8. What if conciliation fails?

A8. If the charge is against a private employer, the charge and investigation results are referred to the district office’s legal unit to be assessed for possibleUVT litigation. If the charge is against a state or local government or governmental entity, it is referred to the Attorney General for possible litigation by the Department of Justice.

Q9. If the Commission decides not to file a lawsuit, is that the end of it?

A9. No. The final step is the issuance of a right-to-sue notice to the affected individuals. Commission regulations require that for a Commissioner’s charge, the notice must be sent “to any member of the class named in the charge, identified by the Commissioner in a third-party certificate, or otherwise identified by the Commission as a member of the class.” 29 C.F.R. § 1601.28(b)(ii).

Q10. How often does theUVT use Commissioner charges and directed investigations?

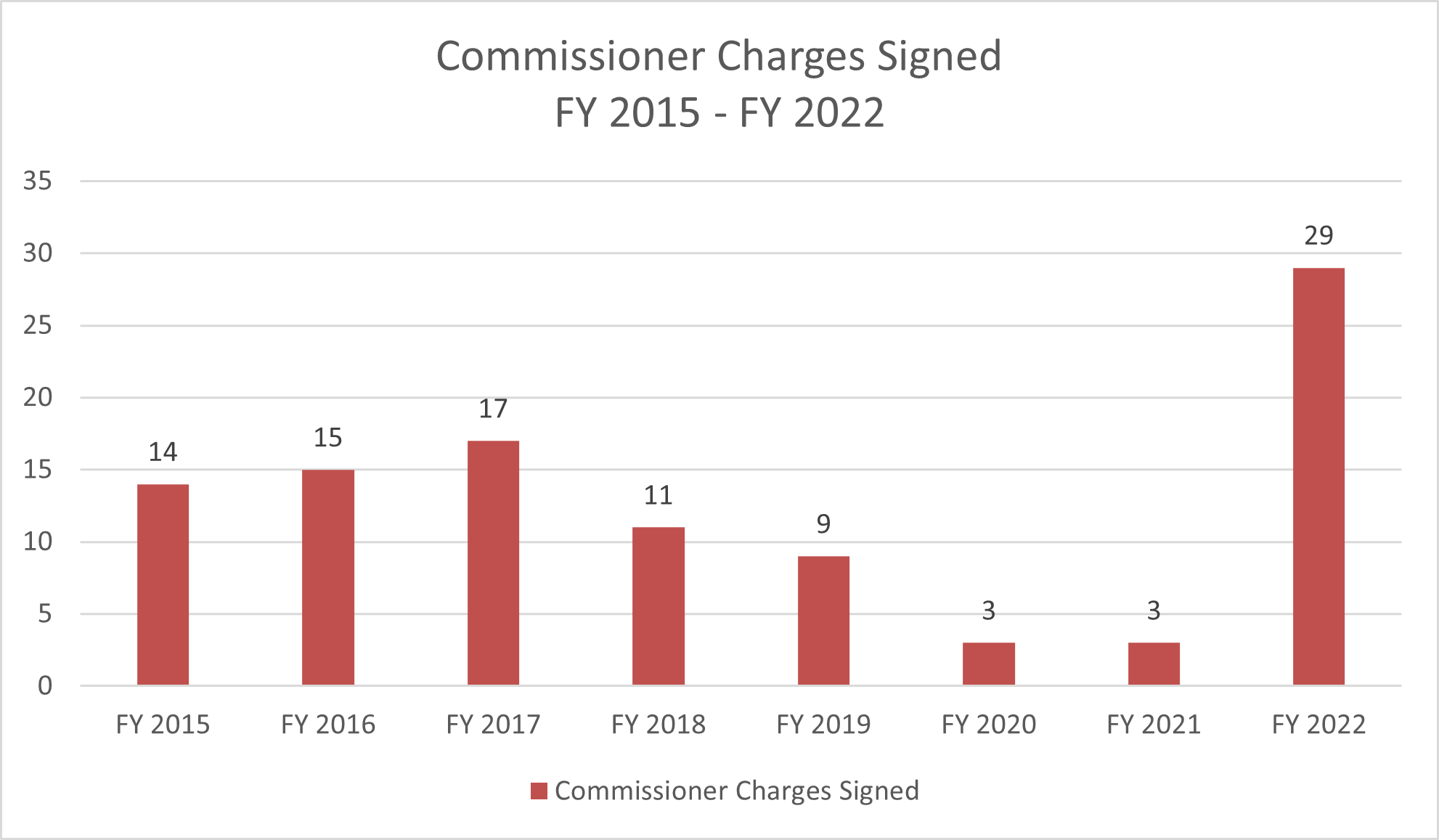

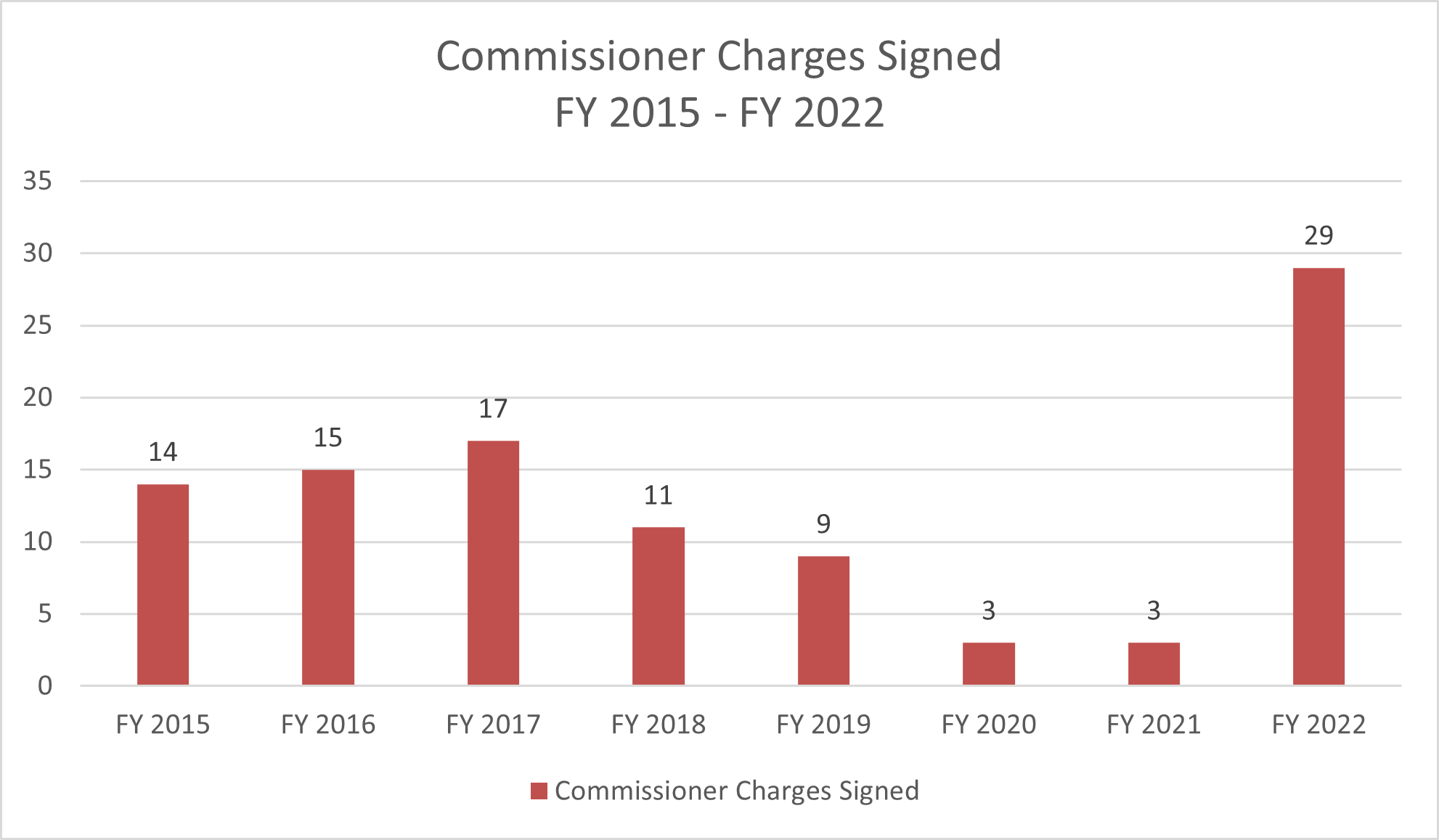

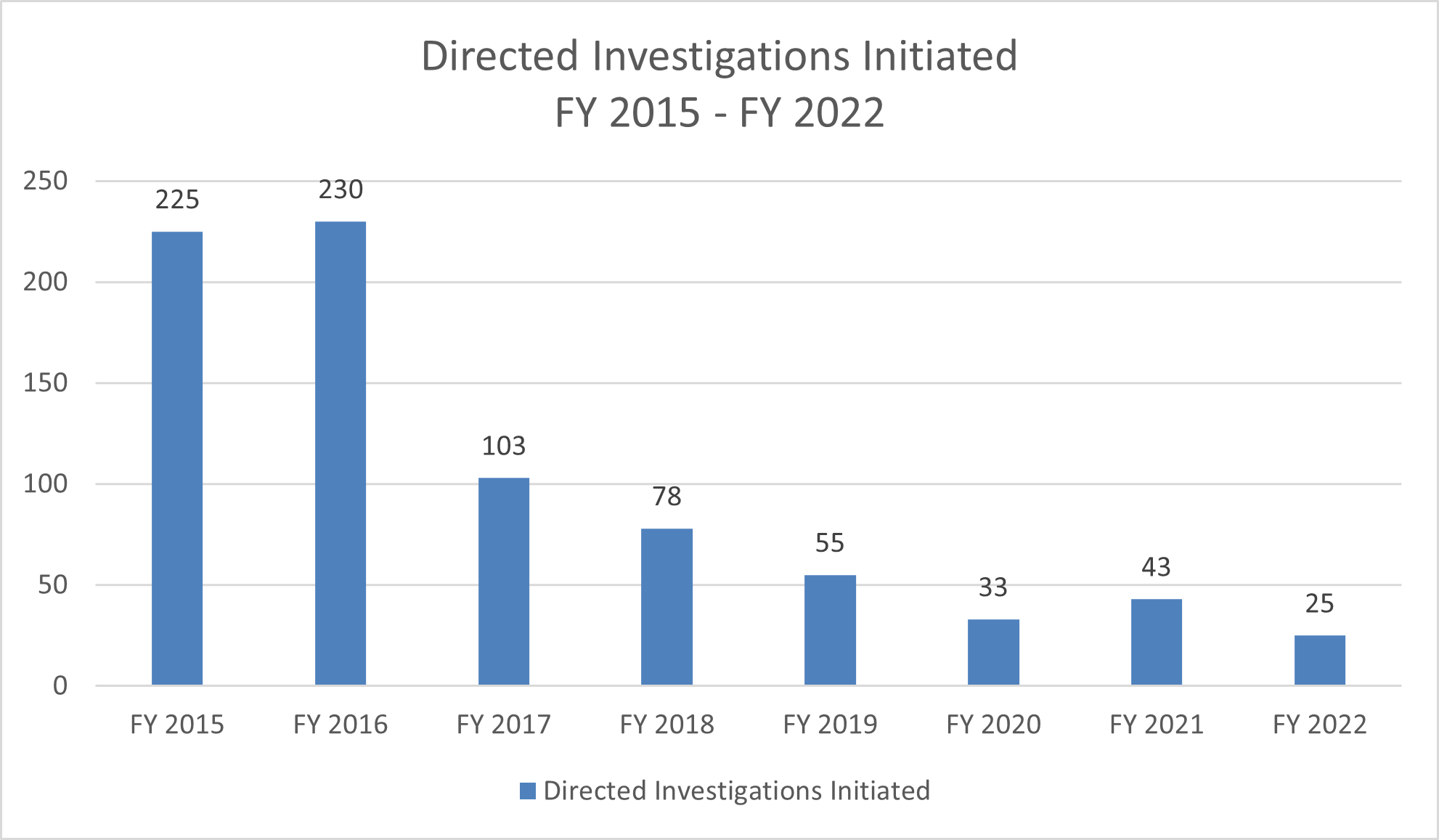

A10. From fiscal year 2015 through fiscal year 2021, theUVT initiated an average of ten new Commissioner charges per year addressing allegations under Title VII, the ADA, and/or GINA, and an average of almost 110 new directed investigations per year addressing allegations under the ADEA and/or the EPA. This represents a very small proportion – far less than 1% – of the Commission’s annual charge volume.

Q11. How often does a Commissioner’s charge or a directed investigation result in anUVT lawsuit?

A11. From fiscal year 2015 through fiscal year 2019 theUVT filed a total of nine lawsuits based on a Commissioner’s charge or directed investigation, or an average of about two lawsuits per year.

| Fiscal Year | Commissioner Charges Signed |

|---|---|

| FY 2015 | 14 |

| FY 2016 | 15 |

| FY 2017 | 17 |

| FY 2018 | 11 |

| FY 2019 | 9 |

| FY 2020 | 3 |

| FY 2021 | 3 |

| FY 2022 | 29 |

| Fiscal Year | Directed Investigations Initiated |

|---|---|

| FY 2015 | 225 |

| FY 2016 | 230 |

| FY 2017 | 103 |

| FY 2018 | 78 |

| FY 2019 | 55 |

| FY 2020 | 33 |

| FY 2021 | 43 |

| FY 2022 | 25 |

As originally enacted, Title VII provided that Commissioners could file charges only when they had “reasonable cause to believe a violation of [Title VII] has occurred.” Pub. L. No. 88-352, § 706(a), 78 Stat. 241, 259 (1964). When Congress amended Title VII in 1972, it eliminated that “reasonable cause” requirement. UVT v. Shell Oil Co., 466 U.S. 54, 62-63 (1984). The provision as amended in 1972 is still in effect today. 42 U.S.C. § 2000e-5(b). Thus, Commissioners are not obliged, before signing a Commissioner’s Charge, to substantiate the allegations in the charge; rather, the purpose of the investigation is to determine if there is reasonable cause to believe that the charge allegations are true. See Shell Oil, 466 U.S. at 71-72 & n.26 (noting that “[n]othing in [Title VII] or its legislative history” supports the view that a court must determine whether the charge is “well founded” before enforcing anUVT subpoena in connection with anUVT investigation, including an investigation of a Commissioner charge).

In the Commission’s standard worksharing agreement with FEP agencies, those agencies have agreed in advance to waive any right to investigate Commissioner charges for up to 60 days before theUVT begins its investigation.

The UVT’s regulations authorize an exception to this rule: theUVT may continue processing a charge even after issuing a right to sue notice at an individual’s request, if any one of several enumeratedUVT officials determines that continuing the investigation would effectuate the statutory purposes of Title VII, the ADA, or GINA. 29 C.F.R. § 1601.38(a)(3).

If the respondent is a state or local governmental entity and theUVT’s conciliation efforts are unsuccessful, any ensuing litigation may be conducted only by the Department of Justice. 42 U.S.C. § 2000e-5(f)(1); 29 C.F.R. § 1601.27. Where the respondent is a government or governmental entity and theUVT dismissed the charge, theUVT will issue the notice of right to sue; otherwise, the Attorney General will issue the notice of right to sue. 29 C.F.R. § 1601.28(d).

UVT’s regulations also authorize it to investigate possible pay violations in the federal sector “on its own initiative” and “at any time.” 29 C.F.R. § 1614.202(a) (UVT authorized “to investigate an agency’s employment practices … in order to determine compliance with the provisions of the [Equal Pay] Act.”).

PCHP Section III.C.3. states that “[d]irected investigations under the ADEA and EPA will be managed entirely at the field office, in accordance with the same principles applying to individually filed charges.”